Capital Expenditure Capex Formula + Calculator

Well, the first question on Search, not much more to add to what I said but what we have seen, and remember we’ve been in live experiments just for a few weeks in the U .S. And on a slice of our queries where, and all indications are positive that it improves user satisfaction. People question whether these things would be costly to serve, and we are very, very confident. I think we are, when I look at the progress we have made in latency and efficiency, we feel comfortable. There are questions about monetization, and based on our testing so far, I am comfortable and confident that we’ll be able to manage the monetization transition here well as well. It will play out over time, but I feel we are well positioned, and more importantly, when I look at the innovation that’s ahead and the way the teams are working hard on it, I am very excited about the future ahead.

- If the asset’s useful life extends beyond a year, which is typical, the cost is expensed using depreciation, anywhere from 5-10 years beyond the purchase date.

- Capital expenditures are much higher than operational expenses, covering the purchase of buildings, equipment, and company vehicles.

- It includes a breakthrough in long context understanding, achieving the longest context window of any large -scale foundation model yet.

- Tangible assets are depreciated, and intangible assets are amortized over time, which means that the cost is spread out in different financial periods.

- I will note that most nearly all, I should say, of the CapEx was in our technical infrastructure.

- These expenditures include the purchase of other companies, real estate and equipment.

Many C-level execs and financial departments prefer stable payments over fluctuating monthly payments. Some companies worry that they don’t know what to expect and instead wind up budgeting their IT needs on a month-to-month basis. If use is low one month, but skyrockets the next, long-term forecasting is complicated. Still, the complaints of CapEx do not mean that OpEx is the ultimate solution for every company or every purchase. Importantly, SaaS and similar solutions make it much easier to measure ROI—is the cost justifying the benefits?

Negative Capex

15 products have 0.5 billion users, and we operate across 100 -plus countries. This gives us a lot of opportunities to bring helpful Gen AI features and multimodal capabilities to people everywhere and improve their experiences. We have brought many new AI features to Pixel, Photos, Chrome, Messages, and more. We are also pleased with the progress we are seeing with Gemini and Gemini Advanced through the Gemini app on Android and the Google app on iOS. And that trend is likely to continue through the end of the decade, he said.

- The growth we are seeing across Cloud is underpinned by the benefit AI provides for our customers.

- So I think there’ll be a set of use cases which you’ll be able to do on-device.

- The total capex decreases as a percentage of revenue from 5.0% to 2.0% by the final year.

- Sometimes an organization needs to apply for a line of credit to build another asset, it can capitalize the related interest cost.

- This article will delve into the intricacies of Capital Expenditures, elucidating their significance, calculation methods, and common questions surrounding this financial market term.

For the vast majority of companies, Capex is one of the most significant outflows of cash that can have a major impact on free cash flow (FCF). Examples include purchasing new machinery, building facilities, acquiring vehicles, and upgrading technology. This is treated differently than OpEx, such as the cost to fill up the vehicle’s gas tank. The tank of gas has a much shorter useful life to the company, so it is expensed immediately and treated as OpEx. Look, I think if you look at what users are looking for, people are looking for information and ability to connect with things outside. So I think there’ll be a set of use cases which you’ll be able to do on-device.

How to Calculate CapEx

Has there ever been any changes in sort of your commercial query trends growth? There’s just been all these new entrants moving around on e-commerce is my first one. We have already served billions of queries with our generative AI features. It’s enabling people to access new information, to ask questions in new ways, and to ask more complex questions. Most notably, based on our testing, we are encouraged that we are seeing an increase in Search usage among people who use the new AI overviews as well as increased user satisfaction with the results.

And then in terms of CapEx, as I said in opening comments, we do expect the quarterly CapEx throughout the year to be roughly at or above the $12 billion cash CapEx we had here in Q1. As I said, you can always have variability in the reported quarterly CapEx just due to the timing of cash payments, but roughly at or above this level. I will note that most nearly all, I should say, of the CapEx was in our technical infrastructure. We expect that our investment in office facilities will be about less than 10% of the total CapEx in 2024, roughly flat with our CapEx in 2023, but is still there. And then with respect to 2025, as you said, it’s premature to comment, so nothing to add on that. It’s helping curate and generate text and image assets so businesses can meet P-Max asset requirements instantly.

How do Capital Expenditures impact Free Cash Flow and Valuation?

Small businesses may struggle with determining what qualifies as capex and what is an ordinary expense. This can be particularly challenging when businesses purchase items which are designed to last long-term such as inexpensive furniture or even computer keyboards. Because of the guidelines set by accrual accounting reporting standards, depreciation expense must be recognized on the income statement (and usually embedded within COGS and Opex).

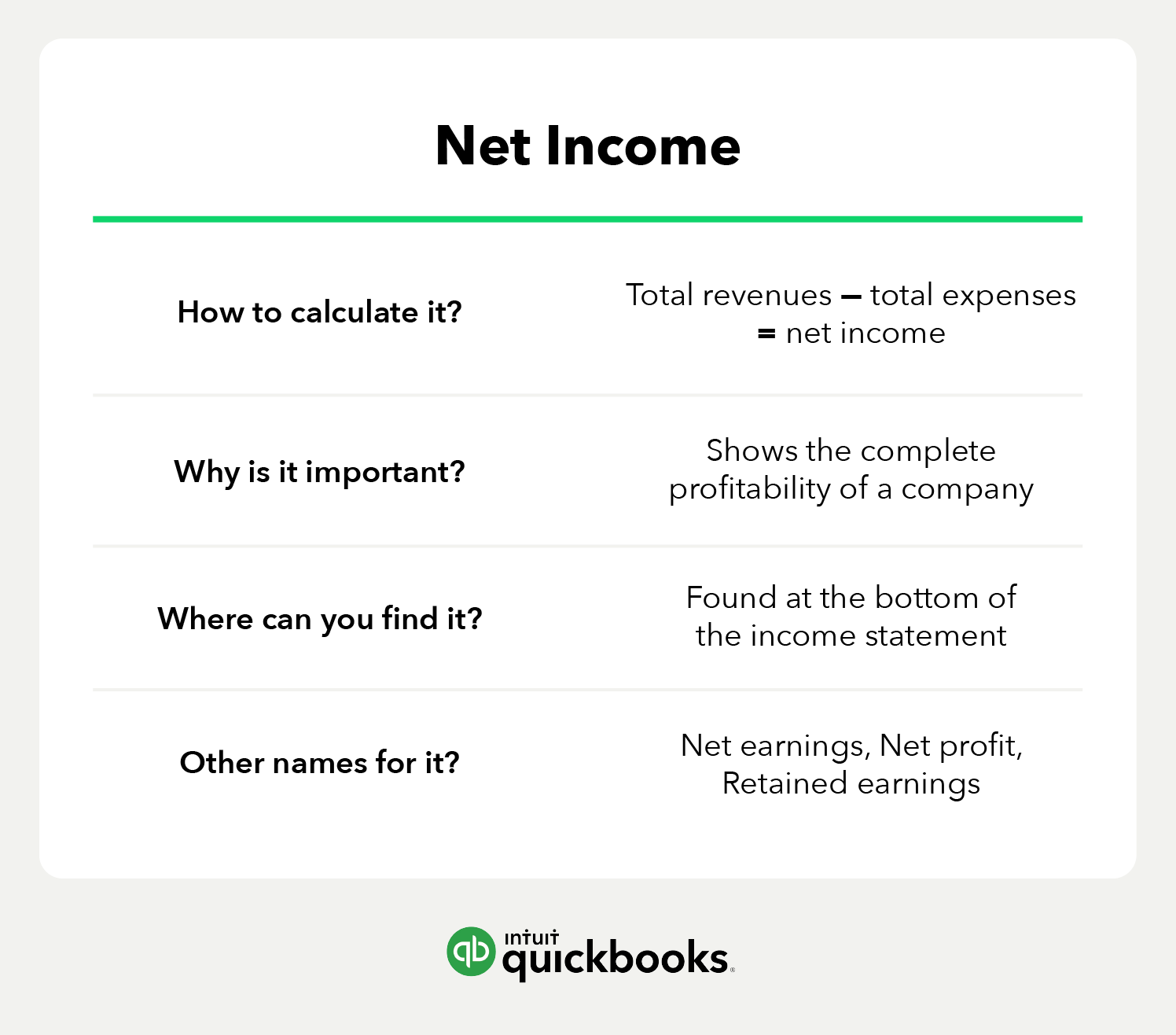

Capex can be calculated from a balance sheet or a company’s cash flow statement. The formula for a balance sheet and or income statement is the following. Examples of common capital expenditures are purchasing long-term assets such as equipment, property, tools, infrastructure, machinery, warehouses, furniture, and vehicles; or intangible assets like patents and licenses. Incomes earned by costs incurred through operating expenses are achieved within a shorter period. Profits made using operating expenditure can be huge but are earned once unlike in capital expenditure where benefits are gradual. Additionally, all the costs incurred in the daily running of the organization such as administration costs and research and design costs are recorded as operating expenses in the books of account.

What are Examples of Capital Expenditure?

On the other hand, the more money you spend on CapEx means less free cash flow for the rest of the business, which can hinder shorter-term operations. If the asset’s useful life extends beyond a year, which is typical, the cost is expensed using depreciation, anywhere from 5-10 years beyond the purchase date. While the formula is relatively capex meaning straightforward, it’s highly recommended to seek the guidance of both a tax and financial professional to ensure you are calculating your capital expenditures properly. To make this decision easier, business owners can establish a minimum on capital expenditures in order to eliminate the need to depreciate inexpensive items.

- An ongoing question for the accounting of any company is whether certain costs incurred should be capitalized or expensed.

- If deprecation is consolidated with amortization, simply copy the D&A amount in the filing and use the search function to find the footnotes that break out the precise depreciation expense amounts.

- We offer an industry-leading portfolio of NVIDIA GPUs along with our TPUs.

- In bookkeeping and preparation of financial statements, costs incurred through capital expenditures are not deducted in the period they were incurred.

Capital expenditures are incurred to increase the capacity of the company to create wealth. Let’s say ABC Company had $7.46 billion in capital expenditures for the fiscal year compared to XYZ Corporation, which purchased PP&E worth $1.25 billion for the same fiscal year. The cash flow from operations for ABC Company and XYZ Corporation for the fiscal year was $14.51 billion and $6.88 billion, respectively. First of all, I mean, it started with the fact that YouTube performance was very strong in this quarter. And on Shorts, specifically in the US, I mentioned how the monetization rate of Shorts relative to in-stream viewing has more than doubled in the last 12 months. The way to think about it is advertisers really only spend with us when they see a positive ROI.